Maximum alpha is achieved by being first to exploit information disconnects in the most overlooked areas of the stock market

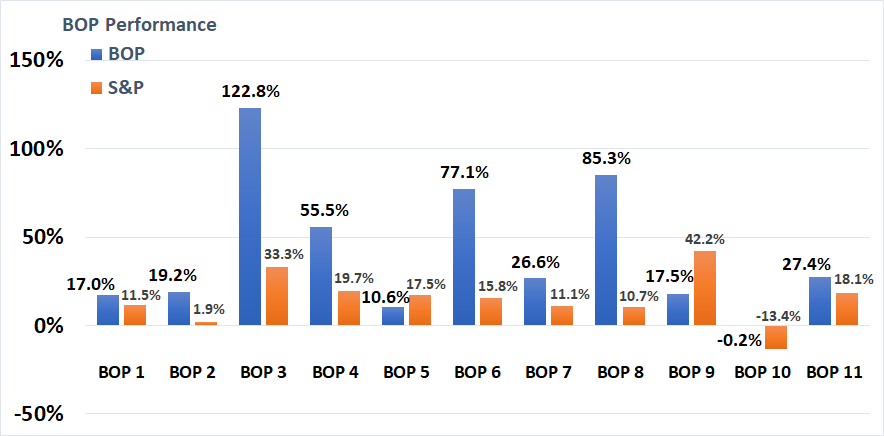

Our “Buy on Pullback” (BOP) Model Portfolios Consistently Beat The Market

An 89-year-long study proves that investing in microcap stocks beats the returns of large-cap stocks by 8.24% per year. We combine this microcap edge with our 30+ years of investing experience to find the best stocks to provide our premium subscribers with an even much bigger edge to capture large short and long-term returns.

Warren Buffet, Peter Lynch & Joel Greenblatt stress that microcap stocks provide investors with the best returns.

Our strategies encompass a wide range of investment strategies from traditional value investing to special situations.

Why Trust GeoInvesting's Proprietary Research and Stock Ideas?

1500 +

Equities Covered

200 +

Multibaggers

30 +

Years Of Investing Experience

200 +

Management Interview Clips

1500 +

Equities Covered

200 +

Multibaggers

30 +

Years Of Investing Experience

200 +

Management Interview ClipsGet ALL the Following Features with a

Premium Subscription

Ideas | Research | Education

- Actionable High Conviction Stocks from GeoInvesting’s research and analyst team.

- Stock pitches from our Premium subscriber investor network.

- Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- Stock Research updates.

- Morning “get your day started” emails.

- 15 Years of archived research on over 1500 companies and counting.

- Access to our Live and Archived CEO Interviews.

- Weekly Newsletter and Monthly Live/Archived Forum, just in case you missed our updates and alerts.

- Education on investment process and case studies.

Get All The Following Features with a Premium Subscription.

Stock Ideas From Our Expert Microcap Research Team

New ideas and updates to existing stock research, relayed via email, premium alerts and research notes.

Vetted Microcap Contributors

A vetted network of stock aficionados navigate the microcap space with us and pitch their best stock picks.

In-depth Stock Research

Transparency: We back up our stock pitches with detailed research, timely research updates, and give you a look into our new idea research pipeline.

Education & Case Studies

Content that best describes the same strategies we used to find over 200 multibaggers since 2007.

What Our Members Are Saying

Why Trust Our Contributors?

8 yrs.

How long contributors have been pitching stocks to Geo

1000 %

9 contributor pitches rose by at least this much

8790 %

All-time high return on a contributor pitch

41

Stock pitches that more than doubled

8 yrs.

How long contributors have been pitching stocks to Geo

1000 %

9 contributor pitches rose by at least this much

8790 %

All-time high return on a contributor pitch

41

Stock pitches that more than doubledOur stock analysts will help you decipher the difference between high and low-quality microcap stocks. We focus on investing in microcap stocks because this universe offers the last real advantage available to you that can enable you to exceed the returns of the stock market and large-cap stocks by a meaningful margin made possible because financial media and most investors ignore this universe of stocks. This allows GEO to find ideas on microcap stocks early and share them with our premium subscribers before the rest of the market finds them after their prices have already risen.

Our primary focus is to invest in quality stocks that will rise significantly in price over the long term. And while the majority of investors are thinking shorter term these days, we take pride that we are able to think outside the box, understanding that the best investors in history let their money compound over time, and that’s who we will take our cue from. Did you know that the average time an individual investor will hold a stock has dropped from 6 years to 6 months?

Furthermore, take a guess at what the average annual return was for individual investors in Fidelity’s Magellan fund when it averaged 29.3% a year for 13 years when legendary portfolio manager, Peter Lynch, ran the fund? If you guessed less than 5% you would be correct. Peter Lynch conducted a study on why individual investors underperformed by so much, concluding that they were buying when the market was going up and selling when the market was going down, a symptom of letting fear and greed create a short term investing focus.

Now, even though we are primarily longer term investors, we don’t mind nimbly surrounding this focus with short term opportunities when they arise. We also understand that you may be more focused on shorter term opportunities. Regardless of the time horizons of our investing strategies, we primarily focus on using fundamental research to find higher quality stocks to invest in.

Ultimately, we want to implement strategies that the crowd is avoiding, which means investing for the long term and investing in quality microcap stocks. You are going to be hard pressed to find many firms like us, that offer long term stock investment services in the microcap universe as well as provide the expert stock investment education that we do.

Our stock analyst education and other stock investment services will help you grow as an investor. However, when you learn how to invest in stocks, it will take time and patience. So the earlier you can find your investing passion, the faster you will find success.

In the book, Outliers, author Malcolm Gladwell concludes that it takes ten thousand hours to master a skill. That works out to about three and a half years, working eight hours every day including weekends and holidays! If you took weekends and holidays off and a standard two-week vacation, it would take you just over 5 years of work. That also assumes you are going to be 100% productive and loaded with Red Bull when you are working. Our team has been investing for 30 years and are still learning.

Our team is highly focused helping you learn how to think long term and invest in stocks through our stock market education services.

In the end, stock education is what makes a good investor become a great investor. We offer a plethora of learning materials to keep you sharp as an investor. And if you’re new to the world of investing, you’ll successfully learn how to become an investor through our services.

If you want to learn how to become a successful stock investor, reach out to our team to get started.

To sum it all up, Geoinvesting’s analysts and full time investing team have decades of experience in stock investing education and understanding and analyzing companies trading in the stock market. Our research identifies what we believe are some of the best stocks to invest in. If you’re new to the stock world, our model portfolios will help you greatly and aid you in learning how to build your own portfolios and with learning stock buying strategies.

We have been providing premium investment services since 2007 with a loyal premium membership that sticks around, year after year. We think this proves that Geoinvesting’s stock picking education, deep-dive research and attention to detail in the microcap stock universe is best in class.

But, we are not just blind bulls in the stock market. You may have heard about The China Hustle, a documentary movie that featured Geoinvesting’s role in cleaning up fraud in the stock market. Between 2010 and 2014, close to $15 billion in investor capital was lost directly because of fraudulent activities by U.S. listed Chinese companies.

This experience helped us evolve our services into one that not only seeks out Tier One microcap stocks to invest in, but also focuses on portfolio protection services for our members by identifying red flags and warning you about potentially fraudulent U.S. companies.

Over the past 13 years, Geoinvesting has:

- Uncovered 14 proven U.S. listed China based Frauds

- Identified 23 U.S. pump and dump scams

- Written several red flag research reports

Our portfolio and risk protection angle is just another form of investment education you can use to help to at times protect your portfolio in your investment journey.

Consider Joining The GeoInvesting Community

If you’re interested in learning how to become a better investor, sharpen your investing skills, or are an experienced investor looking for a place to begin your own research, GeoInvesting can help. We provide the most comprehensive research in the microcap space. Our 16-year microcap coverage universe archive, available to premium members, will ensure that you stay up-to-date in your quest to find the best stock ideas in GeoInvesting's pipeline. We give you the resources to find ideal stocks to invest in, as well as stock buying and selling strategies. Our resources are also perfect for investment groups and investment clubs looking to include microcaps as a class supplement. GeoInvesting simply makes it easy and hassle-free to supplement your own research, or if you are more of a beginner, learn how to become an investor. If you’re interested in finding out what we believe are some of the best stock picks today and for the long term, please consider signing up to be a member. Join thousands of investors who use GeoInvesting daily to connect with other like-minded investors and expand their research capabilities and stock market education. To get started, give us a call at (800) 891-1526 or send us an email at support@geoinvesting.com. We can’t wait to assist you in your investing journey.

We offer model portfolios for investors, investment clubs, and investment groups that can connect with your own investing style. Each model portfolio contains a set number of stocks, depending on the portfolio’s given strategy. If you’re new to the stock world, these model portfolios might be of great help to you. Geoinvesting’s most popular model portfolios include the:

- Favorite portfolio which contains Tier One microcap stocks that we believe will compound significantly over time, basically our highest conviction stocks

- Buy on Pullback portfolio, taking advantage of stocks that have fallen in price for no good reason

- Run To One portfolio

We’re constantly monitoring and updating our model portfolios and stock buying and selling strategies, regardless of the trends going on in the stock market. If you’re interested in using Geoinvesting to start learning how to become a successful stock investor, we believe that our track record speaks for itself.

Besides stock education, stock picking ideas, video investment pitches, investor solutions, and model portfolios that beginner investors benefit from at GEO, we also provide other stock investment services that more experienced investors, such as stock analysts and fund managers, have been utilizing since 2007.

Investors use GEO to help them with their own research or as a way to add ideas to their own research pipeline. Our members appreciate that we perform in-depth research on companies, going beyond press releases to read SEC filings and conference call transcripts. Our stock analysts also perform on-site company visits and interview CEOs and CFOs of companies we are researching. Our nearly daily premium newsletters written by our own stock analysts provide breakdowns of company earnings reports, as well as stock coverage updates on stocks entering and exiting our model portfolios. Our analysts publish:

Detailed research reports on our highest conviction microcap stocks

Shorter form reports, or what we call Reasons For Tracking, on stocks that are just starting to attract our interest

Quick daily and weekly research briefs on stocks in our coverage universe

We were recently contacted by a premium member who said:

Thank You Geo! Hi Maj & the Geo team, I joined Geo in October so I can’t technically say “thanks for a great year”, but I have every intention of being able to next year! You can consider my subscription recurring revenue. Joining Geo was a big transition from how I previously traded but it has been the best decision I’ve made since starting this journey in 2014. I love the research-driven approach to the opportunity-abundant microcap market and the ability to use my accounting and finance background in decision-making, without having to monitor every market move. My account hit a record annual % gain this year even though I joined in October. The generous market probably helped, but so did Geo. Thanks for everything you do, and I wish you all the best in 2021! Aaron

To be clear, beginner to intermediate investors will also see tremendous benefits from the intense microcap stock research we do and the stock investing education we provide. We allow our members to experience the kind of research and stock analyst education that Wallstreet only saves for their wealthiest clients.

If you are new to investing, Geoinvesting provides the best stock education around and can teach you how to become an investor. We’re one of the best companies around that can help you learn how to invest in stocks and find the best microcap stock picks today. Our services are also beneficial to investment clubs and investment groups.

A key characteristic that sets our company apart from the rest of the pack is our thorough stock investment education. Our mission is to be premier purveyors of due diligence and education on how to safely and effectively invest in the stock market. That’s why stock market education is a huge priority for our team.

If you are just starting your investment journey or relatively new to the game, you may be wondering how to choose stocks to invest in. This is easier said than done.

Although we provide the research and resources, stock investing education is much more than being handed information. It’s about truly understanding and learning about stock buying strategies and investing processes. That is why we encourage you to keep up with our findings if you subscribe to Geoinvesting.

That’s where our microcap investment experts come in. Our investment experts are always available to help you better understand the research we’ve completed. We provide some of the best stock analyst education, tools, and resources to show you how we find stocks we invest in. We are confident that once you observe our stock investment process, you’ll realize that it is some of the best stock education you will ever receive.

Besides providing actionable stock buying and selling strategies, we believe that stock education is crucial for our members to become successful participants in the stock market. Without the proper stock investment education, it would be difficult for our members to make informed decisions that are in their best interest. You’ll learn how to invest in stocks through the education and resources we provide.